✅ Introduction: Can You Use PayPal in Uganda?

Yes — you absolutely can use PayPal in Uganda. Despite some limitations, PayPal remains one of the most secure and convenient platforms for making international payments online, and many Ugandans already use it successfully.

Whether you’re looking to:

💼 Pay for services such as freelancing platforms, website hosting, or graphic design

💻 Buy software licenses (e.g., Adobe, Microsoft, antivirus programs)

🎓Enroll in online courses or webinars (e.g., Udemy, Coursera, Skillshare)

📺Pay for streaming services or memberships (e.g., Netflix, Canva Pro, Spotify Premium)

🛒 Shop on international eCommerce sites (e.g., eBay, AliExpress), …

PayPal works perfectly for sending money from Uganda to merchants and service providers across the world.

However, there’s a catch — and it’s important.

Uganda is classified by PayPal as a “send-only” country. This means that if you create a PayPal account with Uganda as your country of residence, you will only be able to:

✅ Send money

✅ Pay for goods and services online

But you will not be able to:

❌ Receive money from clients, customers, or friends

❌ Accept payments for products or freelance services

❌ Withdraw funds to your bank or mobile money

❓ Why is receiving on PayPal not allowed in Uganda?

This restriction is due to PayPal’s internal compliance policies and risk assessment procedures, which affect certain countries — including Uganda. While the full technical reasons are not made public, they typically involve regulatory compliance, financial systems infrastructure, and digital risk mitigation.

💡 But don’t worry — there’s a workaround. Many Ugandan freelancers, content creators, and online business owners use a fully functional PayPal account created through a supported country like Kenya, South Africa, the United States, or the UAE. With such an account, you can activate both the “Send” and “Get Paid” features — which allow you to receive funds, make withdrawals, and fully integrate PayPal into your online business.

We’ll walk you through that method in a later section.

We are going to talk about:

📝 What You Need Before Creating a PayPal Account in Uganda

🌐 Step-by-Step Guide: How to Open a PayPal Account in Uganda

📧 How to Verify Your Email Address with PayPal

💳 How to Link a Debit or Virtual Card to Your PayPal Account (Ugandan Options)

🔐 How to Secure Your PayPal Account: Passwords, 2FA & Best Practices

💸 Can You Receive Money with PayPal in Uganda?

🏦 How to Withdraw PayPal Funds in Uganda: Banks, Mobile Money & Virtual Accounts

⚠️ Common Issues Ugandans Face with PayPal — And How to Solve Them

📌 Final Tips for Ugandans Using PayPal Safely & Efficiently

In-case you would like us to assist you setup PayPal which can receive and send, Call or whatsapp us on +256706686059 or write us an email service@webvatorshops.us

Is PayPal Available in Uganda and How Is It Used?

PayPal is available in Uganda, but primarily for sending purposes. Due to PayPal’s restrictions on several African countries, including Uganda, the “receive” functionality is not officially supported for Ugandan accounts. However, by setting up a virtual PayPal account, Ugandans can access both the “send” and “receive” features. This type of account can help you make payments and receive money in Uganda, bypassing the usual limitations set by PayPal for the region.

Is a Virtual PayPal Account the Same as PayPal?

A Uganda Virtual PayPal account is essentially a real PayPal account, but with a crucial difference—it comes with the “Pay and Get Paid” feature instead of just the “send” only feature.

This feature can be found in the menu of your PayPal account and is what enables you to pay and receive money internationally, similar to PayPal accounts without regional restrictions. We refer to it as a “virtual” account mainly because you don’t typically link a Ugandan bank account to it. Instead, the account can receive money directly to the available PayPal balance, providing a versatile alternative for users in Uganda.

This feature can be found in the menu of your PayPal account and is what enables you to pay and receive money internationally, similar to PayPal accounts without regional restrictions. We refer to it as a “virtual” account mainly because you don’t typically link a Ugandan bank account to it. Instead, the account can receive money directly to the available PayPal balance, providing a versatile alternative for users in Uganda.

Tips to Consider When Setting Up the PayPal Account

When setting up a virtual PayPal account, it’s crucial to follow best practices to avoid any issues. Here are some tips to consider:

- Use Accurate Information: Always use your real name and address details during the setup process. Using fake names or unverifiable information can lead to account suspension or limitations.

- Verify Your Email and Phone Number: Make sure to use a valid email address and phone number that you have access to, as you will need to verify these to fully activate your account.

- Secure Your Account: Choose a strong password and enable two-factor authentication (2FA) to enhance the security of your PayPal account.

- Understand PayPal’s Policies: Familiarize yourself with PayPal’s terms of service and usage policies, especially those related to international transactions and currency conversion fees.

Step by Step on How to Create a Virtual PayPal Account

When creating a virtual PayPal account in Uganda, it’s crucial to use a clean IP address, which means using an internet connection that hasn’t been flagged for suspicious activity. Avoid using public Wi-Fi or shared networks that might have been used for fraudulent purposes in the past. Additionally, refrain from using a VPN during the setup process. PayPal’s security systems can detect VPN usage, which might raise red flags and lead to account restrictions or suspensions.

When creating a virtual PayPal account in Uganda, it’s crucial to use a clean IP address, which means using an internet connection that hasn’t been flagged for suspicious activity. Avoid using public Wi-Fi or shared networks that might have been used for fraudulent purposes in the past. Additionally, refrain from using a VPN during the setup process. PayPal’s security systems can detect VPN usage, which might raise red flags and lead to account restrictions or suspensions.

HERE’S HOW TO DO IT:

Step 1: Visit PayPal’s Official Website

- Open your preferred web browser and navigate to PayPal’s official website by typing in paypal.com. Make sure you’re on the correct website to avoid phishing scams. The site should have a secure connection, indicated by a padlock symbol next to the URL.

Step 2: Sign Up for an Account

- On the PayPal homepage, look for the “Sign Up” button, typically located at the top right corner of the page. Click on it to begin the registration process.

- You will be given the option to choose between a Personal or Business account. For most individuals, a Personal account is sufficient as it allows you to send and receive payments with minimal documentation requirements. A Business account is more suited for companies or individuals conducting high-volume transactions.

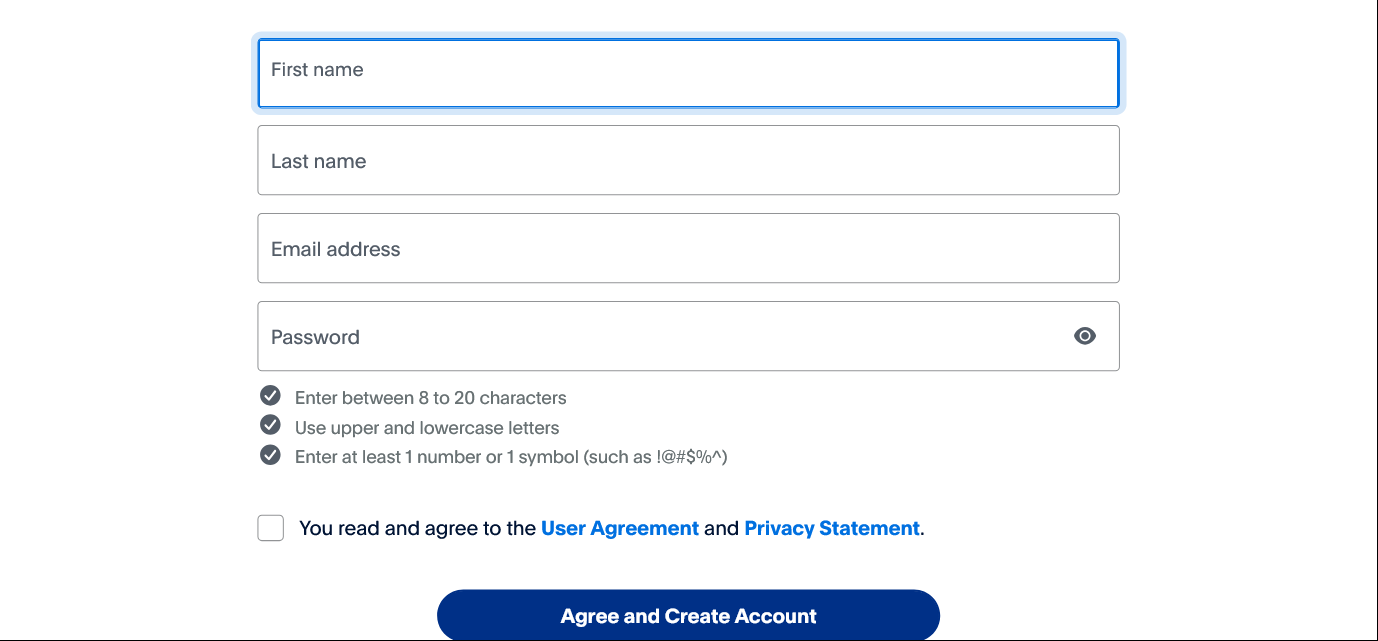

Step 3: Enter Your Personal Information

- You will be directed to a form where you need to fill in your personal details. This includes your first and last name, email address, and a secure password.

- Use an email address that you have full control over, as this will serve as your PayPal account identifier. It’s crucial to provide accurate information that matches your identification documents, as discrepancies can cause issues during verification.

- The password should be strong and unique, combining letters, numbers, and special characters to ensure the security of your account.

Step 4: Verify Your Email Address

- After completing the initial registration form, PayPal will send a verification link to the email address you provided.

- Go to your email inbox, find the email from PayPal, and click on the verification link. It’s advisable to perform this verification step using the same browser you used to create the account, as this can help prevent any technical issues during the process.

- Verifying your email is crucial because it confirms your identity and activates your account for sending and receiving payments.

Step 5: Add a Payment Method

- To fully utilize your PayPal account, you need to link a payment method. Go to the “Wallet” section on your PayPal dashboard and select “Link a card” or “Link a bank.”

- While Ugandan bank accounts are not directly supported for PayPal withdrawals, you can link credit or debit cards issued by banks that work with PayPal. Additionally, you can use virtual cards from services like Eversend or Chipper Cash, which offer international payment functionalities.

- Enter the card details, including the card number, expiration date, and CVV. PayPal may make a small charge to the card to verify it, which will be refunded later.

Step 6: Set Up the “Pay and Get Paid” Feature

- Once your payment method is linked and verified, ensure that the “Pay and Get Paid” feature is active in your account settings. This feature is essential for receiving payments and ensures that your account can be used for both sending and receiving funds.

- Navigate to the “Account Settings” section, and check under “Payment Preferences” to ensure that this feature is enabled. If it’s not visible or active, contact PayPal customer support for assistance.

Step 7: Complete Additional Verification

- PayPal may require additional verification steps to confirm your identity and secure your account. This could include:

- Providing Identification Documents: You may need to upload a copy of your national ID, passport, or driver’s license. Make sure the documents are clear and match the details you provided during registration.

- Phone Number Verification: PayPal may ask you to verify your phone number by sending a code via SMS. Enter this code on the PayPal website to complete the verification.

- Completing these verification steps increases your account’s transaction limits and adds an extra layer of security.

Step 8: Testing Your Account

- Once your account is set up and verified, test it by making a small transaction. This could be receiving a small amount of money from a friend or family member or making a low-cost online purchase. This helps confirm that your account is fully functional and that the “Pay and Get Paid” feature is working correctly

How to Withdraw from a Virtual PayPal Account in Uganda

Withdrawing money from a virtual PayPal account, especially in regions like Uganda where direct withdrawal options may be limited, requires a bit of strategy and understanding of the available methods. Here’s a detailed guide on how you can effectively withdraw money from your virtual PayPal account in Uganda:

1. Linking a Supported Credit or Debit Card

One of the most straightforward methods to withdraw funds from your PayPal account is by linking a credit or debit card that is supported by PayPal. Here’s how you can do it:

- Add a Card: Go to your PayPal account and navigate to the “Wallet” section. Select “Link a card” and enter the card details. While you might not be able to link a Ugandan bank account directly, you can use international prepaid cards like those from banks that support PayPal withdrawals globally.

- Transfer Funds: Once your card is linked and verified, you can transfer the PayPal balance to your card. This process usually involves selecting “Transfer to bank” or “Transfer to card” options within the “Wallet” or “Balance” section of your PayPal account.

- Processing Time: The transfer process typically takes a few business days to reflect on your card. However, some cards offer faster withdrawal times, sometimes within minutes, albeit with additional fees.

2. Using Third-Party Services

In Uganda, several third-party services and platforms have emerged to facilitate the withdrawal of funds from PayPal to local mobile money wallets or bank accounts. While these services can be convenient, it’s crucial to use reputable and trustworthy platforms to avoid scams or excessive fees.

- Selecting a Service: Look for well-known services that have a good reputation for handling PayPal withdrawals. Some services offer direct transfer to mobile money platforms like MTN Mobile Money or Airtel Money, allowing you to access your funds easily.

- Initiating the Transfer: Typically, you will need to provide your PayPal account details and the amount you wish to withdraw. The service will then initiate the transfer process, often taking a percentage as a service fee.

- Receiving Funds: Once processed, the funds will be sent to your chosen method, such as a mobile money wallet. This process can take anywhere from a few minutes to a couple of hours, depending on the service.

3. Transfer to Another PayPal Account

Another method, especially useful if you have access to multiple PayPal accounts, is transferring funds from your virtual PayPal account to another PayPal account that has withdrawal functionality enabled.

- Sending Funds: You can send money from your virtual PayPal account to a friend or family member’s PayPal account that is based in a country with full withdrawal capabilities. This is done through the “Send & Request” feature on PayPal.

- Withdrawal from the Other Account: Once the funds are transferred to the other PayPal account, the recipient can then withdraw the money to their bank account or card and transfer it to you through other means, such as direct bank transfer or cash.

- Trust and Security: This method requires a high level of trust, as you are relying on another person to facilitate the withdrawal process for you. Make sure you only use this option with individuals you trust completely.

4. Using Online Payment Services and Digital Wallets

Some online payment services and digital wallets that operate globally can be linked with PayPal to facilitate withdrawals. These services act as intermediaries between your PayPal account and your local bank account or mobile wallet.

- Creating an Account: Sign up with a global payment service that supports linking with PayPal. These services usually provide a virtual bank account in a country where PayPal withdrawals are possible.

- Linking PayPal: Link your PayPal account to this virtual bank account provided by the service. Transfer your PayPal balance to this account.

- Local Withdrawal: From the virtual bank account, transfer the funds to your local bank account or mobile wallet. Be mindful of the transfer fees and currency conversion rates that might apply.

How to Deposit Money in a Virtual PayPal Uganda Account

Depositing money into your virtual PayPal account in Uganda involves the following methods:

- Receive Payments: The most straightforward way to fund your PayPal account is by receiving payments from other PayPal users. This could include payments for goods and services, freelance work, or transfers from friends and family.

- Link a Card: You can also deposit money by linking a credit or debit card and using it to fund your PayPal balance. Make sure to use a card that supports international transactions.

- Use PayPal Cash Services: If you have access to PayPal Cash services, you can add funds directly to your PayPal balance from participating retailers.

Virtual PayPal account in Uganda: Latest Posts concerning PayPal Uganda , APP Reviews..

Virtual PayPal Account Sign-In: Accessing Your Digital Wallet

The virtual PayPal account functions as a gateway to the world of online transactions, providing you with the ability to send and receive payments, make purchases, and manage your finances with ease. Accessing your PayPal account is the first step to utilizing these services, making the sign-in process a fundamental aspect of your digital financial management. Whether you need to check your balance, transfer funds, or review your transaction history, knowing how to log in is crucial.

Step-by-Step Guide to Logging into Your Virtual PayPal Account

1. Visit the PayPal Website:

To start the sign-in process, open your preferred web browser and navigate to the official PayPal website. You can access it directly through the login link: https://www.paypal.com/signin. This link will take you to the PayPal homepage, where you can begin the process of accessing your account.

2. Locate the Login Button:

On the PayPal homepage, look for the “Log In” button, usually located at the top right corner of the page. This button serves as the gateway to your digital wallet. Click on it to proceed to the sign-in page.

3. Enter Your Email Address and Password:

Once on the sign-in page, you will be prompted to enter the email address associated with your virtual PayPal account. This email serves as your unique identifier within the PayPal system. After entering your email, type in your secure password. It’s important to use the password you created during the account setup process. Ensure that your password is strong, combining uppercase and lowercase letters, numbers, and special characters to enhance security.

4. Enable Two-Factor Authentication (2FA) if Available:

For added security, PayPal offers the option to enable two-factor authentication (2FA). If you have set up 2FA, after entering your password, you will be prompted to enter a one-time code sent to your registered mobile device or email. This step adds an extra layer of protection, ensuring that even if someone obtains your password, they cannot access your account without the additional verification code.

5. Click on “Log In”:

After entering your credentials and completing any necessary security verification, click on the “Log In” button. PayPal will then authenticate your details, and if everything is correct, you will be granted access to your account.

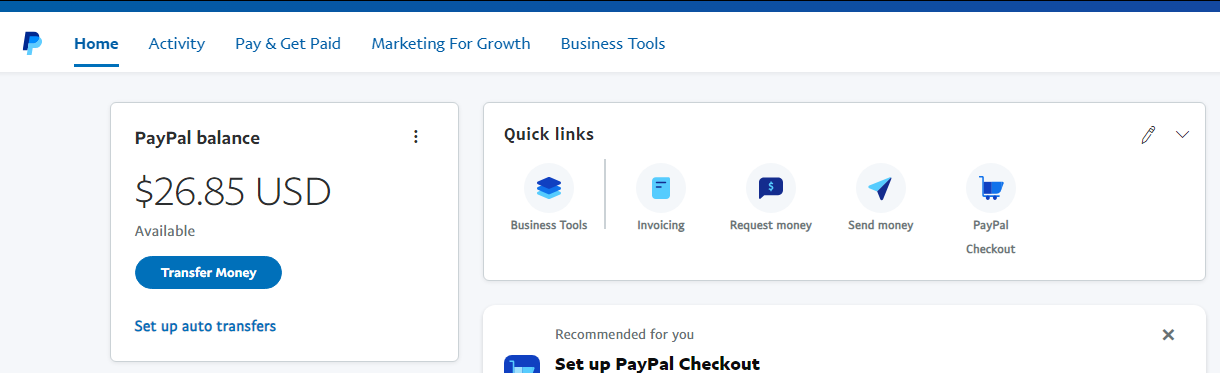

Exploring Your Digital Wallet

Once logged in, you will be directed to your PayPal account dashboard. Here, you can view your account balance, recent transactions, and any linked bank accounts or cards. The dashboard is designed to be user-friendly, providing quick access to various features such as sending and receiving money, making payments, and managing account settings.

How to Check your Virtual PayPal Balance

Checking your PayPal balance is a simple process that you can do either through the PayPal website or the mobile app. Here’s how to do it:

Checking Your Balance on the PayPal Website

- Log In: Go to the PayPal website and log in using your email address and password.

- Navigate to Your Balance: Once you’re logged in, you’ll be taken to your account summary page. Your PayPal balance will be displayed prominently on this page, usually at the top or under the “PayPal Balance” section.

- Detailed View: If you want a more detailed view of your transactions or a breakdown of your balance, click on the “PayPal Balance” or “Wallet” tab. This section will show your current balance, recent transactions, and any funds on hold.

Checking Your Balance on the PayPal Mobile App

- Open the App: Launch the PayPal app on your smartphone. If you haven’t installed it yet, you can download it from the App Store (iOS) or Google Play Store (Android).

- Log In: Enter your email address and password to log in to your account.

- View Your Balance: Once logged in, your PayPal balance will be displayed on the main screen. You can tap on the balance or the “Wallet” section for more details, such as recent transactions and available funds.

Checking Balance in Different Currencies

- If you hold funds in multiple currencies, you can view the balance for each currency. On the website, click on “Wallet,” and you’ll see a list of your balances in different currencies. On the mobile app, go to the “Wallet” section to view the different currency balances.

Additional Tips

- Security: Always ensure you are on the official PayPal website or using the official PayPal app to protect your account information.

- Account Notifications: Enable notifications in the PayPal app to receive updates about transactions and changes to your balance.

- Funds on Hold: If you notice a difference between your balance and the amount available, some funds might be on hold due to pending transactions or disputes. You can view these details in the “Activity” section.

Do you need our services?

Faq

Questions & things to review we think you should know

Below are questions people usually ask us about using Virtual PayPal Uganda Services,

Views: 24322

Views: 24322