Can I Get Paid Through PayPal in Uganda and Withdraw to Bank in Uganda?

In Uganda, the landscape of online payments and international transactions is evolving, yet users still face limitations, especially with PayPal. PayPal is a widely recognized online payment platform that allows users to send and receive payments globally. However, in Uganda, PayPal’s services are restricted, limiting users to mainly sending payments and not receiving them directly into their accounts. Despite these restrictions, there are ways to work around the limitations to get paid through PayPal and potentially withdraw funds to a bank in Uganda.

The Banking Situation in Uganda with PayPal

The Banking Situation in Uganda with PayPal

In Uganda, directly linking a PayPal account to a local bank for withdrawals is not officially supported. PayPal’s regional restrictions mean that users in Uganda cannot receive payments directly into their Ugandan PayPal accounts or withdraw funds straight to a local bank account. This limitation can be challenging for freelancers, businesses, and individuals who wish to receive payments from international clients or customers via PayPal.

However, some Ugandan banks, like Standard Chartered Bank, Equity Bank, and others offer international banking services that can indirectly facilitate transactions with PayPal. But even with these banks, directly receiving payments into a Ugandan PayPal account remains difficult. This has led many to explore alternative methods to receive and withdraw PayPal funds.

Possibilities of Withdrawing to a Bank in Uganda Through Third Parties

Given the direct limitations, many Ugandans have turned to third-party services and platforms to facilitate the process of receiving payments through PayPal and withdrawing them to a local bank account. Here are some common methods:

- Using Third-Party Transfer Services:

Some third-party services act as intermediaries, allowing you to receive payments via PayPal and then transfer the funds to you through other means, such as direct bank transfers, mobile money, or cryptocurrency. These services typically charge a fee for the transaction, and you need to carefully vet the reliability and security of such services before using them. - Freelance and Affiliate Platforms:

Platforms like Upwork, Fiverr, or affiliate programs often accept PayPal as a payment method. These platforms allow you to earn money, receive payments through PayPal, and then withdraw funds using their withdrawal options, which may include bank transfers or other payment processors that support Uganda. - International Bank Accounts:

If you have access to an international bank account that supports PayPal withdrawals, you can link this account to your PayPal profile. Once the funds are transferred to this international account, you can then use international transfer services or platforms to move the money into your Ugandan bank account. This method requires having a legitimate international banking connection, which might not be accessible to everyone.

Creating a Virtual PayPal Account and Linking with a Local Bank

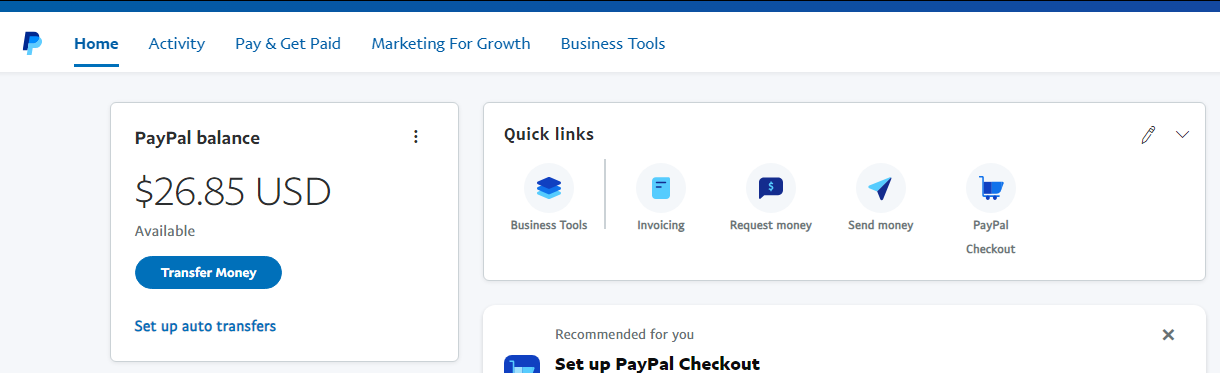

One of the more creative approaches Ugandans use to bypass PayPal’s restrictions is creating a virtual PayPal account. While this term isn’t officially recognized by PayPal, it refers to setting up a PayPal account with a workaround that enables users in restricted countries to send and potentially receive payments. Here’s how you might approach this:

- Create a Virtual PayPal Account:

- Visit the PayPal website using the Virtual PayPal Account Creation Link: https://www.paypal.com

- Sign up for a PayPal account using your legitimate information. Choose either a personal or business account based on your needs.

- Complete the necessary verification steps, including linking a bank account or credit/debit card.

- Linking with an International Bank or Card:

- If possible, link an international bank account or a credit/debit card that supports PayPal transactions. This step is crucial as it provides a means to withdraw funds indirectly.

- You may consider using virtual banking services that offer international cards, which can then be linked to PayPal.

- Work with Third-Party Services for Withdrawals:

- If you do not have an international bank account, consider using third-party services that facilitate the withdrawal process. They can help transfer the funds from your PayPal account to your local bank or mobile money account.

- While using these services, be aware of any fees and ensure they are reputable to avoid scams.

- Use Currency Conversion Services:

- If you’ve managed to receive funds into an international account or a linked card, you can use currency conversion services to convert the money into Ugandan Shillings (UGX) before transferring it to your local bank account.

Important Considerations

- Compliance and Security: When using these methods, it’s important to stay within PayPal’s terms of service to avoid account limitations. Avoid using incorrect information during account creation, as this can result in account suspension.

- Fees and Exchange Rates: Be mindful of the fees associated with third-party services and currency conversion rates, as they can significantly impact the amount you receive.

- Third-Party Service Reliability: Always choose reputable and trustworthy third-party services to ensure your funds are secure and you receive them in a timely manner.

While receiving payments directly through PayPal in Uganda and withdrawing to a local bank account presents challenges, there are several workarounds to consider. Using third-party services, creating a virtual PayPal account with international banking connections, and leveraging international platforms can help you manage your funds and access your earnings. However, each method comes with its own set of risks and considerations, so it’s crucial to carefully evaluate and choose the option that best suits your needs while ensuring compliance with PayPal’s policies. By navigating these options wisely, you can successfully get paid through PayPal in Uganda and withdraw your funds to a local bank account.

FAQs about PayPal Uganda:

1. Can I Receive Money with PayPal in Uganda?

Yes, it is possible to receive money in Uganda if you create a PayPal account with the “Pay and Get Paid” feature, though this is not officially supported for Ugandan users. Some people bypass this limitation by setting up a PayPal account using details from countries where the receiving feature is available. However, this comes with risks, such as account limitations or potential suspension if PayPal detects account inconsistencies.

2. Is PayPal Safe to Use in Uganda?

2. Is PayPal Safe to Use in Uganda?

Yes, PayPal is highly secure to use in Uganda. It employs advanced encryption, fraud detection, and buyer protection policies to safeguard your financial information. These security measures make PayPal a reliable and trusted platform for online transactions, both locally and internationally.

3. Can I Link My Ugandan Bank Account to PayPal?

You can link your Ugandan bank account or debit/credit card to PayPal for making payments, but PayPal does not currently support receiving payments into Ugandan bank accounts. This means you can use your account to shop online or send payments, but you cannot directly withdraw PayPal funds to your Ugandan bank account.

4. What Are the Fees for Using PayPal in Uganda?

PayPal charges various fees depending on the type of transaction and currency conversion. For instance, there are fees for converting currencies when sending money internationally, as well as charges for certain types of transactions. It is advisable to always check PayPal’s official website for the latest fee structure, as these fees can vary based on the transaction and destination.

5. Can I Withdraw Money from PayPal in Uganda?

Direct withdrawals from PayPal to Ugandan bank accounts are not officially supported. However, some users report being able to link certain bank cards and receive funds into their accounts, though this is inconsistent and may not always work. This workaround is not guaranteed, and PayPal can block such transfers at any time, so it is not a reliable method for regular withdrawals.

6. Can I Use PayPal for Online Shopping in Uganda?

Yes, you can use PayPal to shop online from merchants around the world that accept PayPal as a payment method. This allows you to securely purchase goods and services, making it a convenient option for global e-commerce transactions.

Views: 76