PayPal South Sudan Signup, Receive and Withdraw Process

You have to be careful on the country you choose to use because PayPal will at one time request for some documents. You will be required particular document for verification of the shipping address of another country and other documents, failure to provide them, your account is taken as illegal or fraud by Paypal .

This is where we come in by helping you set up account and get the required documents.

This South sudan PayPal account we will set for you will enable you to; receive money on PayPal from friends and family, games Apps, survey sites, freelancing sites, gogetfunding, and any other platform that can cash out money via PayPal.

Your South sudan PayPal account has to be setup differently and on this page we will discuss about how you can get this account which can receive, get to know the requirements and how to withdraw to Mobile money or to Banks, learn how to get a verified PayPal account in South sudan, virtual cards, etc

PayPal is an American multinational financial technology company operating an online payments system in the majority of countries that support online money transfers, and serves as an electronic alternative to traditional paper methods such as checks and money orders. The company operates as a payment processor for online vendors, auction sites and many other commercial users, for which it charges a fee.

Established in 1998 as Confinity, PayPal went public through an IPO in 2002. It became a wholly owned subsidiary of eBay later that year, valued at $1.5 billion. In 2015 eBay spun off PayPal to its shareholders, and PayPal became an independent company again. The company was ranked 143rd on the 2022 Fortune 500 of the largest United States corporations by revenue.

Summary of Page content

Views: 381

- Is PayPal available in South Sudan?

- How to create PayPal Account in South Sudan 2023?

- How to create a South Sudan virtual PayPal account 2023?

- How to create a verified South Sudan Paypal Account?

- How to receive money on PayPal in South sudan 2023

- Can I use PayPal without a bank account in South Sudan?

- How do I link my Bank Card to South Sudan Paypal?

- Benefits and Disadvantages of using Virtual South Sudan PayPal account

- What Are the Alternatives to PayPal South Sudan?

- How to withdraw money from PayPal to Mobile Money in South Sudan?

Views: 381

About South Sudan

South Sudan ,officially the Republic of South Sudan, is a landlocked country in Eastern Africa. It is bordered by Ethiopia, Sudan, the Central African Republic, the Democratic Republic of the Congo, Uganda, and Kenya.Juba is the capital and largest city.

Is PayPal Available in South Sudan?

If you go to PayPal.com website, you will realize South Sudan doesn’t exist on the countries you can signup with but with the virtual South Sudan PayPal account we can create for you, you can enjoy PayPal. Not sure if PayPal existed in South Sudan or what really pissed off PayPal to a point of completely removing South Sudan from there website but its really being missed by millions of people in South Sudan .

Online sources show Sudan is not a member of the PayPal company because the United States government has imposed economic sanctions on South Sudan, which includes a prohibition on transactions with Sudanese banks. As a result, PayPal is not able to offer its services in Sudan due to these restrictions.Way around this is getting a virtual PayPal account

Creating a PayPal Account in South Sudan

Because South Sudan is restricted from PayPal, this normal account steps below can only help you get a PayPal account to pay with but not to receive. For receiving account, click here to create a pay & Get paid PayPal account

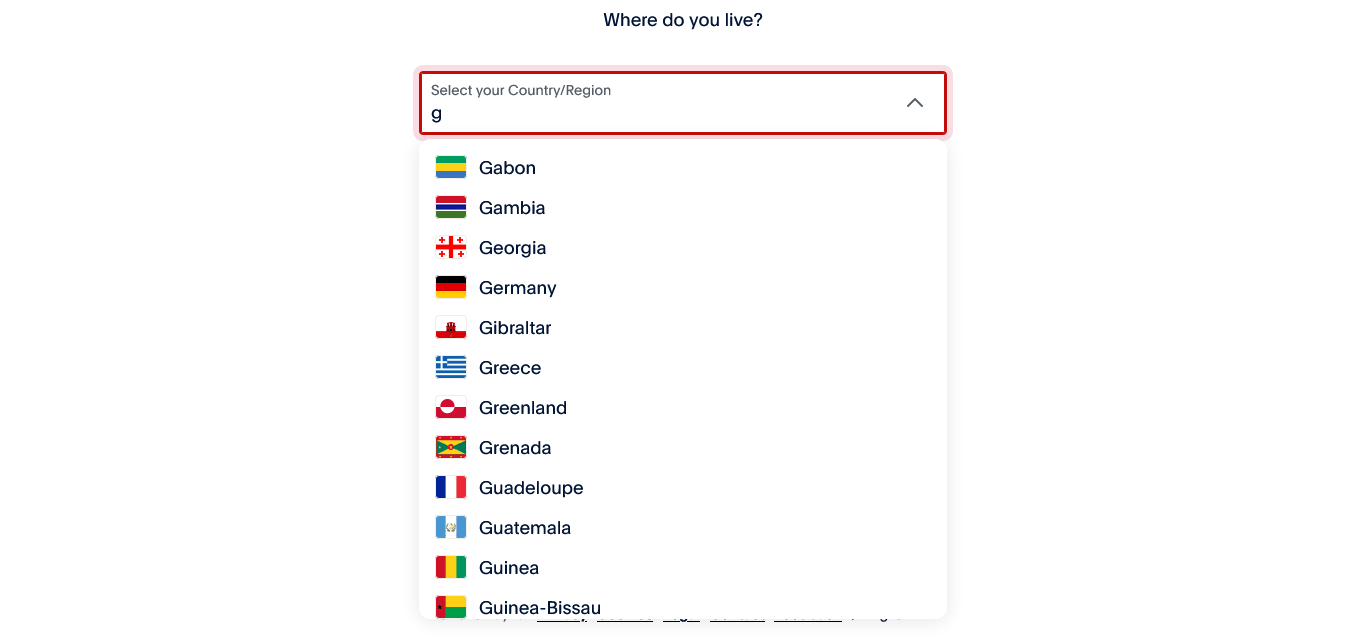

To create a Normal PayPal account in South Sudan to send payments, follow these steps:

- Activate VPN and Go to this PayPal Link https://www.paypal.com/ug/bizsignup/#/singlePageSignup and enter email

- Enter your personal information, including your Password, name, address,.. Make sure the information you provide is accurate and matches your official documents.

- Review the terms and conditions and privacy policy, and click on the “Agree and Create Account” button.

- You will receive a confirmation email from PayPal. Click on the link in the email to verify your email address.

- Once you have verified your email address, you can link your debit or credit card to your PayPal account. Follow the on-screen instructions to do so.

- Alternatively, you can link your bank account to your PayPal account. To do this, click on “Link a bank” and provide your bank account details.

- Once you have linked your payment method, your PayPal account will be set up and ready to use.

How you can create a receiving PayPal Account in South Sudan

PayPal South Sudan account helps you to be receiving PayPal from friends and family, PayPal donations, Payments from game Apps and survey Apps, etc

Incase you want to receive from PayPal in South Sudan, you need to have such an account because South Sudan is restricted.

A “Pay & Get Paid” PayPal account is a either a personal or business PayPal account designed for users who need to both send and receive money easily. This account offers dual functionality, making it suitable for a wide range of personal and business transactions.. The account is created in names of your National ID or Passport, you can use your south Sudan mobile number and your email

How to create the account, and the requirements?

Creating a PayPal with Pay & Get Paid feature is setup by us most cases because it involves compiling some documents to be sent to PayPal, its easy to setup PayPal of USA, UK etc but hard to gain documents needed by PayPal. Using other countries on PayPal comes at a cost of doing documents also, so make sure the person setting up the virtual account for you has capability to do the paper work required by PayPal

For this reason we charge a small fee to facilitate in documents required by PayPal , PayPal is free but documents are made at a fee.

Requirements:

1. You will send us ID/ driving permit or Passport photo

2. Email address

3. Your telephone number

4. Setup Fee (Between $30 to $60) depending on if you want a verified PayPal account or not.

The Paypal with Pay & Get Paid feature usually has no bank card details linked to it but can be verified by entering a virtual card. The only limitation you have is you cant withdraw directly to your bank account since most cases the users of such accounts are from countries restricted from receiving, so when it comes to withdraw, you have to use third party websites to help you withdraw to your mobile money number or bank account.

Just as a normal PayPal account, you cannot use it for crime, if this is your intention, PayPal will find out and freeze your account, same rules apply just as to a normal PayPal account.

This PayPal account can be setup for a business account, Organization account, church or in your personal names.

Sending money from PayPal to South Sudan?

Yes, you can send money from PayPal to South Sudan. However, you should be aware that PayPal has certain restrictions on sending and receiving funds in some countries, including South Sudan.

To send money to South Sudan using PayPal, you will need to have a PayPal account, and the recipient must also have a PayPal account. You can then link your PayPal account to a bank account or a credit card, which you can use to transfer funds to the recipient’s PayPal account.

It’s important to note that PayPal may charge fees for sending and receiving money, and there will be additional fees charged by banks or credit card companies involved in the transaction. It’s also important to ensure that you’re sending money to a reputable recipient in South Sudan, as there have been reports of fraudulent activity involving PayPal transactions in some countries.

If you’re unsure about the process or have specific questions about sending money to South Sudan using PayPal, it may be a good idea to contact PayPal customer service or consult with a financial advisor.

How you can receive money on PayPal in South Sudan

To receive money on PayPal in South Sudan, follow these steps:

- Log in to your PayPal account.

- Click on the “Request Money” button located under the “Tools” tab.

- Enter the email address of the person who is sending you money and the amount you are requesting.

- Click on the “Continue” button to review your request.

- Add a note to your request if necessary and click on the “Request Money” button to send the request.

- The person you requested the money from will receive an email with a link to pay the requested amount. Once they click on the link, they will be redirected to their PayPal account to complete the payment.

- Once the payment is completed, you will receive a notification from PayPal that the money has been credited to your account.

Note that there are some limitations on the services available to South Sudan PayPal users. You cannot use your PayPal account to withdraw money to your South Sudan bank account or card. You can only use your PayPal balance to make purchases or receive payments. Additionally, some types of transactions may be restricted or subject to additional fees.

Can I use PayPal without a bank account?

Yes, you can absolutely use PayPal without linking it to a bank account. This option is particularly useful for individuals who either don’t have a bank account or prefer to use PayPal as a standalone financial platform. Here’s how this works and why it’s convenient:

How It Works Without a Bank Account

- Receiving Money

- When someone sends you money, it will be deposited into your PayPal balance instead of being transferred to a bank account.

- This balance can be used directly within PayPal to make payments or purchases.

- Sending Money

- You can send money using your PayPal balance to pay for products, services, or even transfer funds to another PayPal user.

- No bank account is needed as long as there’s enough money in your PayPal balance to cover the transaction.

- Alternative Withdrawal Options

In countries where PayPal supports additional withdrawal methods, such as linking a debit card, using mobile money services, or withdrawing to a virtual card, you may not need a traditional bank account to access your funds.

Advantages of Using PayPal Without a Bank Account

- Flexibility: Enables users without a bank account to participate in online transactions, including receiving payments and making purchases.

- Convenience: Ideal for freelancers, online sellers, or users who earn through apps, websites, or international platforms that pay via PayPal.

- Security: You don’t have to share sensitive bank account information, which adds an extra layer of financial security.

- Accessibility: Even if you don’t have a bank account, you can still access the benefits of PayPal’s payment ecosystem.

Limitations to Consider

- Restricted Withdrawal Options: Without a bank account, your ability to cash out your PayPal balance might be limited depending on your country.

- Verification Challenges: Some features, like raising withdrawal limits or verifying your account, may require linking a bank account or credit/debit card.

- Limited Usability in Some Regions: In certain countries, PayPal may mandate a bank account or card to enable receiving funds or making withdrawals.

Practical Scenarios of Using PayPal Without a Bank Account

- Making Online Purchases

Use your PayPal balance to buy goods or services from online stores that accept PayPal as a payment method. - Sending Money

Transfer funds from your PayPal balance to other users, whether friends, family, or business contacts. - Freelancing and Gig Work

If you’re earning from freelance platforms or apps that pay via PayPal, you can accumulate your earnings in your PayPal account and use them for online transactions or transfers.

There are several alternatives to PayPal in South Sudan. Some of the popular alternatives include:

- Mobile Money: Mobile money is a popular payment option in South Sudan, and it allows users to transfer money and make payments using their mobile phones. Some of the popular mobile money providers in the country include MTN Mobile Money, Zain Cash, and NilePay.

- Bank Transfer: Bank transfers are also a common way to make payments in South Sudan. Most major banks in the country offer online and mobile banking services that allow customers to transfer funds and make payments.

- Payoneer: Payoneer is an international payment platform that is available in South Sudan. It allows users to receive payments from clients and customers worldwide, and withdraw their funds to a local bank account or via ATM.

It’s important to note that some of these payment options may not be as widely accepted as others, and there may be fees associated with using them. It’s always a good idea to research and compare different payment options before choosing one to ensure that it meets your needs and budget.

Benefits and Disadvantages of using a PayPal account

PayPal is a fast, secure way to pay online. We help you make purchases at millions of online stores in the U.S. and across more than 200 global markets – all without the hassle of converting currency.

- You can use PayPal to receive payments from several Apps like Game Apps, survey websites and Apps, Tiktok, YouTube channel payments, you can use your PayPal account to cashout money from crowdfunding platforms like gogetfunding and others

- You can receive donations from anywhere in the world by using PayPal donation links. People can donate you money using there cards or PayPal funds . You can even receive donations for personal use without an NGO which is not possible on other platforms

- PayPal can be integrated on your website to make it quick for people to pay you

- PayPal doesn’t maintenance fees, u can set it up for free

- You can use your PayPal account on all websites supported by paypal like behance, ebay, shopify and other online stores

- PayPal has over 400 Million users, you get a chance to access one of the world’s largest networks of givers.

While PayPal has many advantages, there are some drawbacks to using the service.

Here are some of the major disadvantages:

- Fees: Certain transactions, such as receiving payments, sending payments, and currency conversions, are charged by PayPal.

These fees can add up over time, especially if you use the service frequently. - Concerns about security: Over the years, PayPal has been the target of numerous hacking attempts and scams, raising questions about the platform’s security.

While PayPal has taken steps to improve security, using the service still carries some risk. - Limited seller protections: While PayPal offers some protections for buyers, it is less generous when it comes to protecting sellers. This means that if you are a seller on PayPal, you may be at risk of charge backs or disputes that can result in lost revenue.

- Account freezes: PayPal has been known to freeze user accounts for a variety of reasons, including suspected fraud or terms of service violations.

This can be a significant annoyance, especially if you rely on PayPal for your business or personal finances. - Customer service: Some users have reported having difficulty contacting PayPal customer service or resolving issues quickly.

This can be aggravating if you have a problem with the service and require assistance.

Overall, while PayPal is a popular and convenient payment platform, it is critical to weigh the potential drawbacks against the benefits before deciding whether or not to use the service.

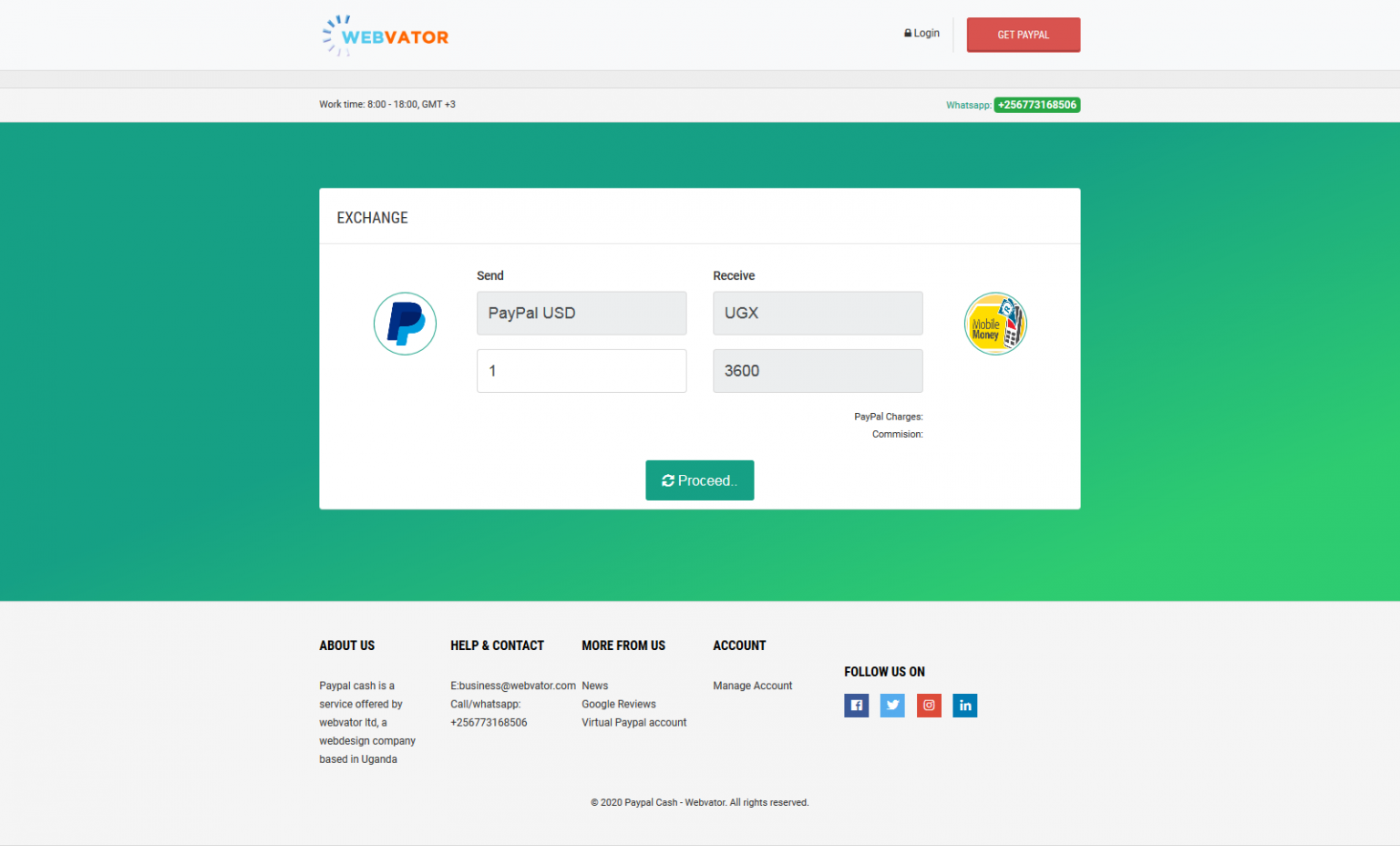

Withdrawing money from Paypal in South Sudan?

If you want to withdraw money in your paypal in South Sudan, we provide the services here,

https://paypalcash.webvator.com

We can process Money within minutes for an amount less than 1,500 Dollars, more than that, it can be processed within 24 hours

Popular Topics;

👉 How to create a Virtual PayPal account in Uganda

👉Apps that pay $100 a day | Websites that pay $100 a day

👉How to Make Money from Amazon Affiliate Links on Pinterest

👉How To Use FREE Minimax AI Video Generator To Make Money

👉How to Make Money With Hailuo AI Minimax FREE Video Generator

👉 How To Use FREE Hailuo AI Image To Video Generator To Make Money

👉 Get Paid to Test Apps and Websites | Make money Online Fast

👉How to Make Money as an Online Chat Moderator

👉Top Websites That Pay You to Read

👉 How to Make Money Without Talking to Anyone

👉 Ways to Make Money as a 13-Year-Old Online for Free

👉 How to Make Money Online as a Teenager in Australia

👉 Ways to Make Money Online as a Teenager in the USA

👉 5 best skills to learn to make money

👉 Best Ways to Make Money Online as a Teenager

👉 How to make money on PayPal

👉 How to make money on Google Maps

👉 legit games that pay real money instantly

Views: 381

Views: 381