Step-by-Step Guide to Filling in USA Tax Info for AdSense for Non-USA Citizens

As a non-USA citizen, providing your tax information correctly is essential to avoid unnecessary withholding on your AdSense earnings. Below is a detailed step-by-step guide to filling in the USA tax information for Ugandan publishers in AdSense.

1. Access the Tax Information Section

- Log in to your Google AdSense account.

- Navigate to Payments in the left-hand menu.

- Click Manage settings and scroll to the Payments profile section.

- Under United States tax info, click Add tax info to start the form.

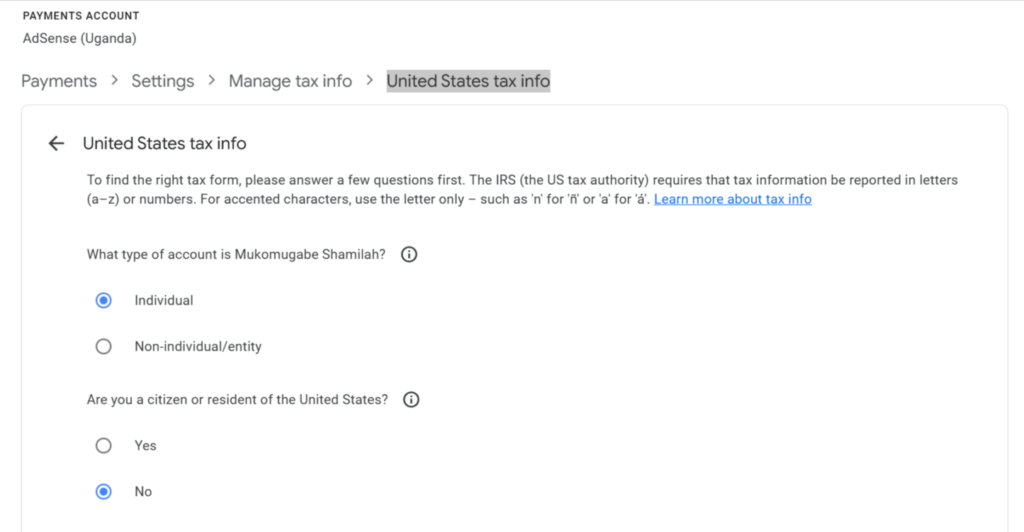

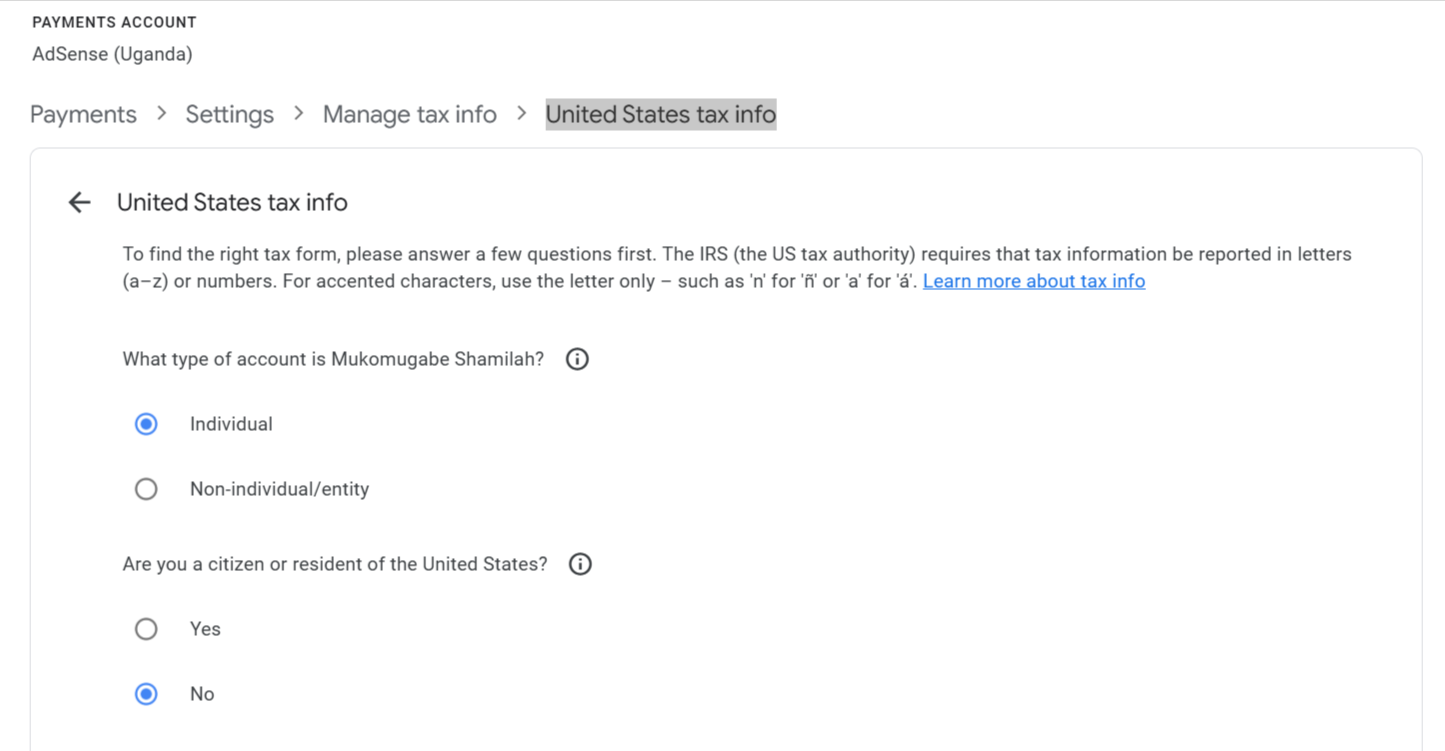

2. Tax Identity

- You will be asked to select the W-8 tax form that applies to you.

- For Ugandans and other non-US individuals, choose W-8BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting).

- Click Start W-8BEN form.

3. Provide Personal Information

- Full Name: Enter your full legal name as it appears on official documents.

- Country of Citizenship: Select Uganda from the dropdown menu.

- Foreign TIN:

- Input your Tax Identification Number (TIN) from Uganda. If you don’t have one, leave this blank (but it’s better to provide one to avoid higher withholding rates).

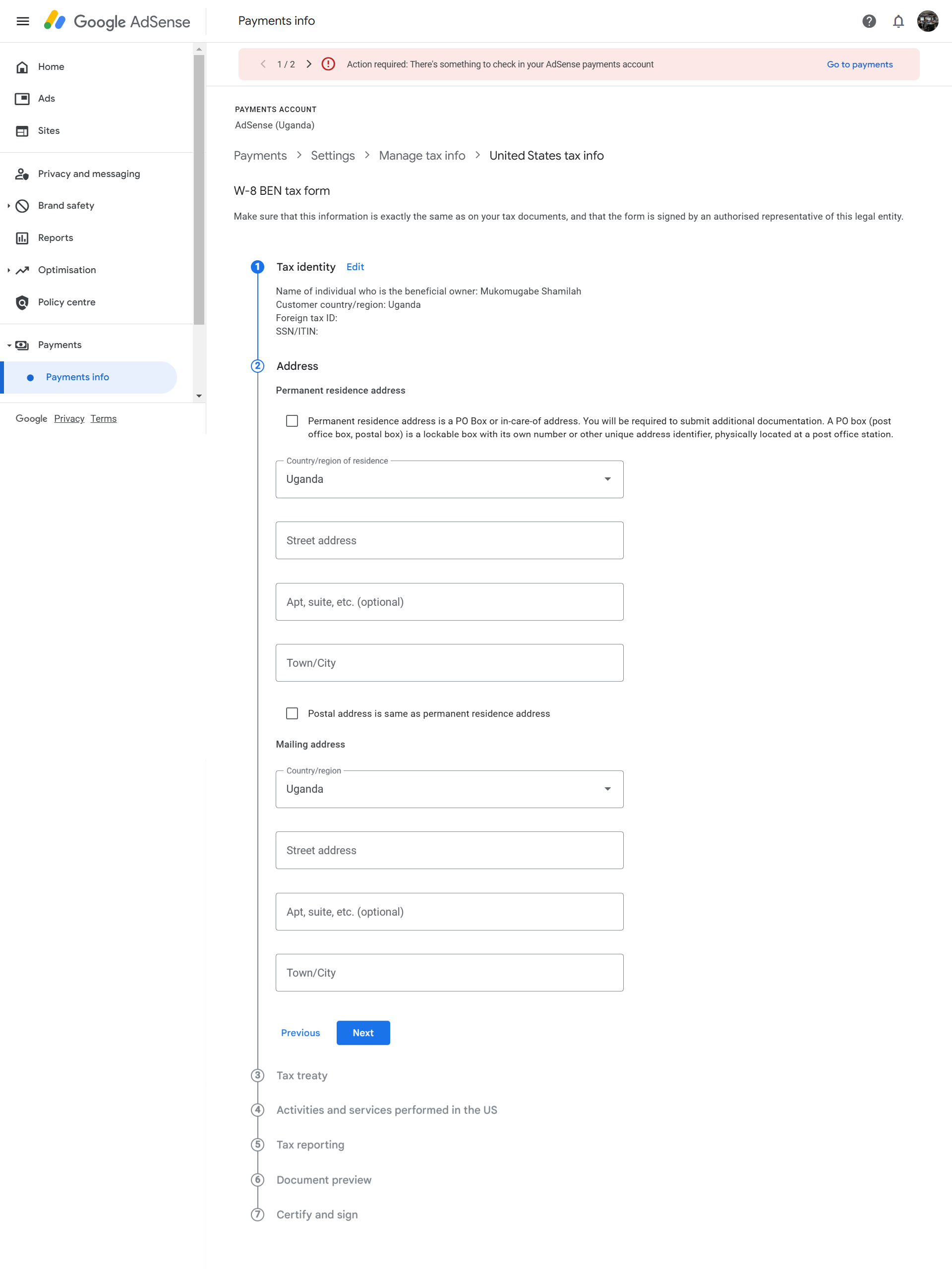

4. Address

- Enter your permanent residence address. Ensure this matches your official address in Uganda.

- Street Address: Provide your complete address (e.g., Plot 10, Kampala Road).

- City: Enter your city (e.g., Kampala).

- Region/State: Enter your region (e.g., Central Region).

- Postal Code: Provide your postal code (e.g., 256001).

- Check the box for Mailing address is the same as permanent residence, unless your mailing address is different.

5. Tax Treaty

- Claim Tax Treaty Benefits:

- Unfortunately, Uganda does not have a tax treaty with the USA. This means you cannot claim reduced withholding rates on your AdSense earnings.

- Select No to the question asking if you’re claiming a tax treaty.

6. Activities and Services Performed in the U.S.

- Confirmation of Services:

- You will be asked whether your activities (e.g., creating content for AdSense) are performed in the United States.

- Select No, as your activities are conducted entirely in Uganda or outside the USA.

- Check the box confirming that you provide services outside the U.S.

7. Tax Reporting

- Review the information provided for accuracy.

- Signature:

- Enter your full legal name to electronically sign the document.

- Confirm that you are signing on your own behalf as the beneficial owner.

8. Document Preview

- After submitting your information, you’ll see a preview of the W-8BEN form you completed.

- Review it thoroughly to ensure all details are correct.

9. Submit Your Tax Information

- Click Submit to send your tax information to Google AdSense.

- Once submitted, Google will review your details, and you’ll receive a notification confirming whether your tax info has been accepted.

10. Withholding Tax Rates

- Since Uganda does not have a tax treaty with the USA, the default withholding rate of 30% will apply to your AdSense earnings derived from U.S. viewers.

By following these steps, you can ensure that your AdSense tax information is filled out correctly as a Ugandan. This will help avoid unnecessary errors or delays in receiving your payments.

Views: 7

Popular Topics;

👉How to Make Money with Wealthy Affiliate

👉 What Can I Invest In to Make Money ?

👉 How to fill inUSA Tax Info for AdSense for Non-USA Citizens

👉 Unable to Connect, Try Again Later WhatsApp Error

👉 QuMatix Automated Trading Bot

👉 DramaBox Gift Codes

👉 Updated Lust Goddess Promo Code PC & Steam

👉 SoFi Bank Review

👉 DoorDash Tips for Beginners

👉 MINISO X30 OWS Translation Wireless Bluetooth Earbuds review

👉 Navy Federal Credit Union Finance Reviews

👉 How to get a Pledge Loan with Navy Federal Credit Union

👉 Ocean Fun Balls Lucky Crash Real or Fake Game App

👉 Watch Videos and Earn Money in Canada, UK and USA

👉 First Home Mortgage: FHA vs. Conventional Loans

👉 Cursive Platform

👉 Move2Cash App Review

👉 EveryDollar Budgeting App REVIEW

👉 My Experience Buying Tickets from AXS UK & Ticketmaster

👉 Top Websites That Pay You to Read

👉 How to Get Delta Executor Roblox

👉 How to Buy Bitcoin & Cryptocurrency in Australia

👉 My Personal Experience Using the AMEX Platinum Card

👉 High-Yield Savings Accounts in Ireland, Europe

Views: 7