Create, Send, Receive, Withdraw and avoid PayPal account suspensions

PayPal has become an indispensable tool for financial transactions in Kenya, offering convenience, security, and global connectivity. Learn how Kenyan users can create PayPal accounts, navigate restrictions, and explore various withdrawal options. While challenges may arise, proactive measures and adherence to PayPal's guidelines can help maximize the benefits of this platform as we're to to disclose.

We delve into all aspects of PayPal in Kenya, covering topics ranging from creating a Kenyan PayPal account, withdrawal options such as Equity Bank Kenya or Mpesa, etc.

Additionally, we'll address PayPal restrictions in Kenya and provide solutions to overcome them.

Before we start, let me share facts about using PayPal in Kenya since people have different myths when it comes to using PayPal in Kenya

Views: 267

How can I receive money through PayPal in Kenya?

Receiving funds from PayPal in Kenya is so much easy

1. Ensure Your PayPal Account is Verified:

This is not a must but a verified PayPal account help build trust and credibility on PayPal. verifying your PayPal account offers peace of mind, added security, and access to a wider range of features and services. It’s a simple process that typically involves confirming your identity and linking a bank account or credit/debit card to your PayPal account.

Before receiving funds, make sure your PayPal account is verified. Verification typically involves linking a bank account or credit/debit card to your PayPal account and confirming your identity. read here why you should verify your Kenya PayPal account

2. Share Your PayPal Email Address:

Provide the sender with your PayPal email address. This is the email address associated with your PayPal account and is used to send payments.

3. Wait for Payment Notification:

Once the sender initiates the payment, PayPal will send you a notification via email and/or through the PayPal website or app.

4. Log In to Your PayPal Account:

Log in to your PayPal account using your email address and password.

5. Review Payment Details:

Navigate to the “Activity” or “Transactions” tab within your PayPal account to review the details of the incoming payment. You should see the sender’s name, the amount received, and the transaction status.

6. Funds Transfer:

Once the payment is processed and available in your PayPal account balance, you can choose to keep the funds in your PayPal account for future purchases or transfer them to your linked bank account.

Views: 267

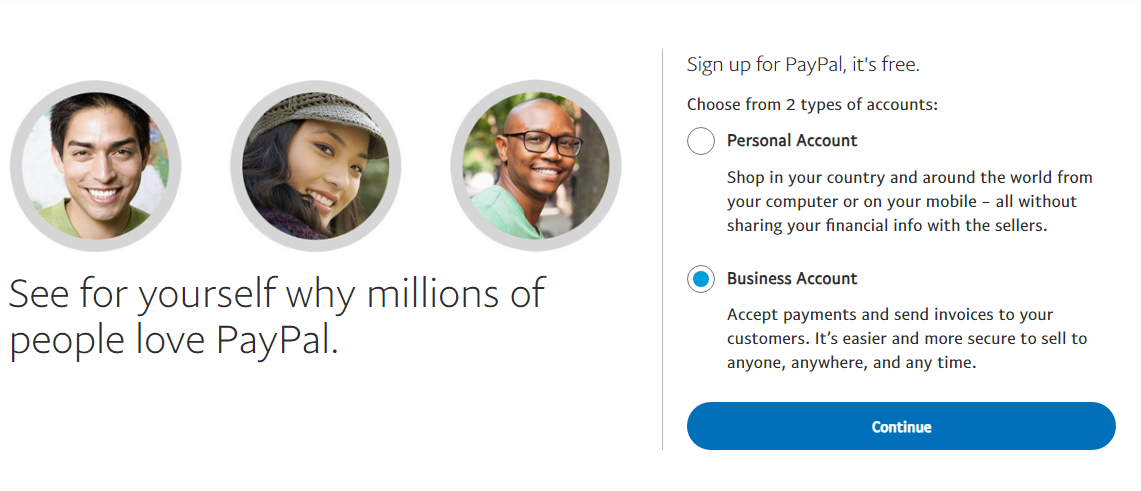

How do I open a Business PayPal account in Kenya?

Opening a Business PayPal account in Kenya is not that hard, just make sure you don’t use VPN during this setup process.

1. Visit the Kenya PayPal Website:

On your computer or phone, type “https://www.paypal.com/ke/webapps/mpp/account-selection” into the address bar and press Enter.

2. Choose between personal or Business PayPal Account”:

PayPal offers different types of accounts, including Personal and Business. For individual use, select the “Personal Account” option. Business choose Business Type.

In this guide, we’re going to create Business PayPal account

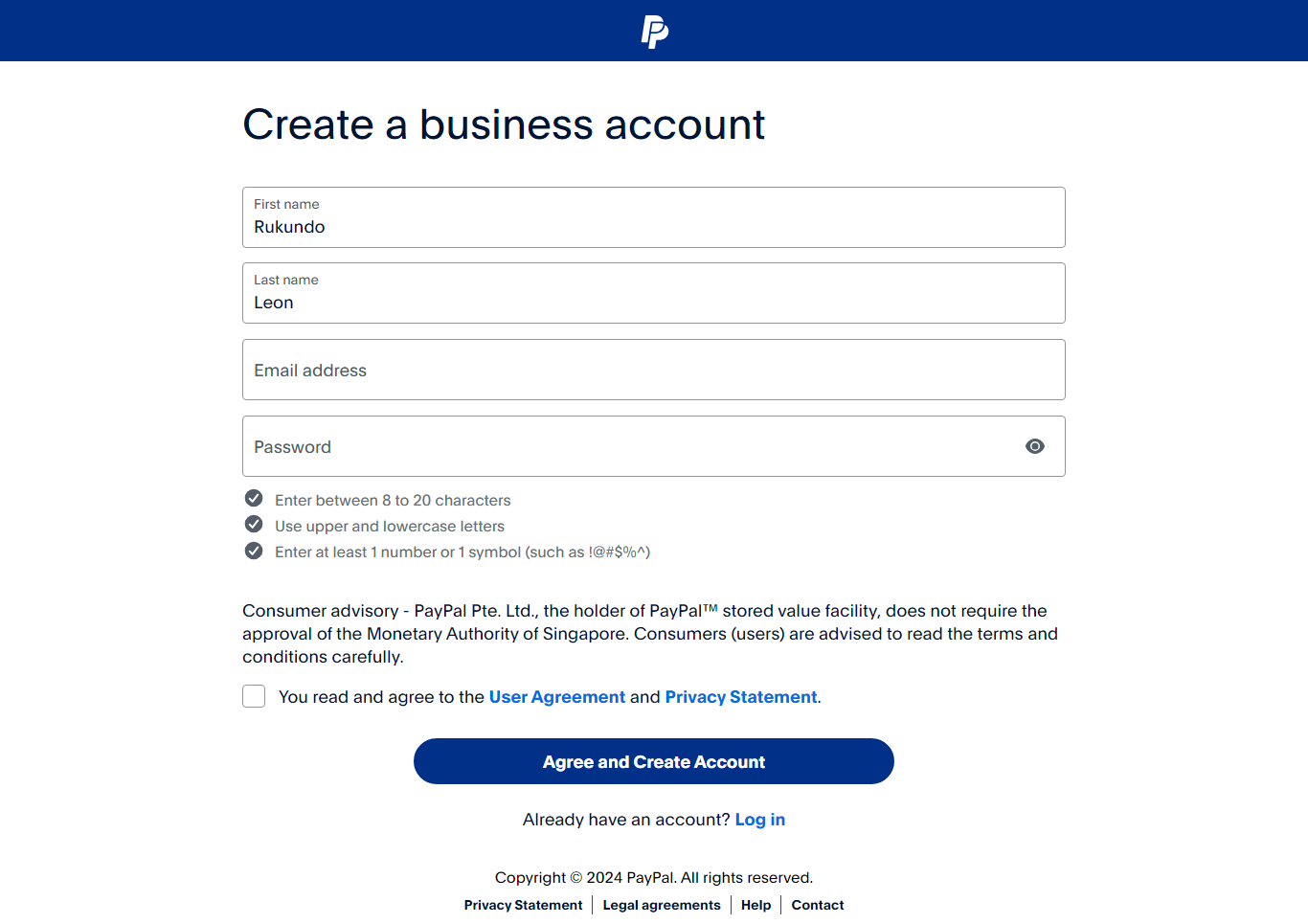

4. Fill in Personal Information:

4. Fill in Personal Information:

Enter your personal details accurately in the provided fields. This typically includes your full name, email address, and a secure password for your PayPal account.

5. Verify Email Address:

After providing your email address, PayPal will send a verification Code and email to the address you provided. Check your inbox (including spam or junk folders) and click on the verification link to confirm your email address.

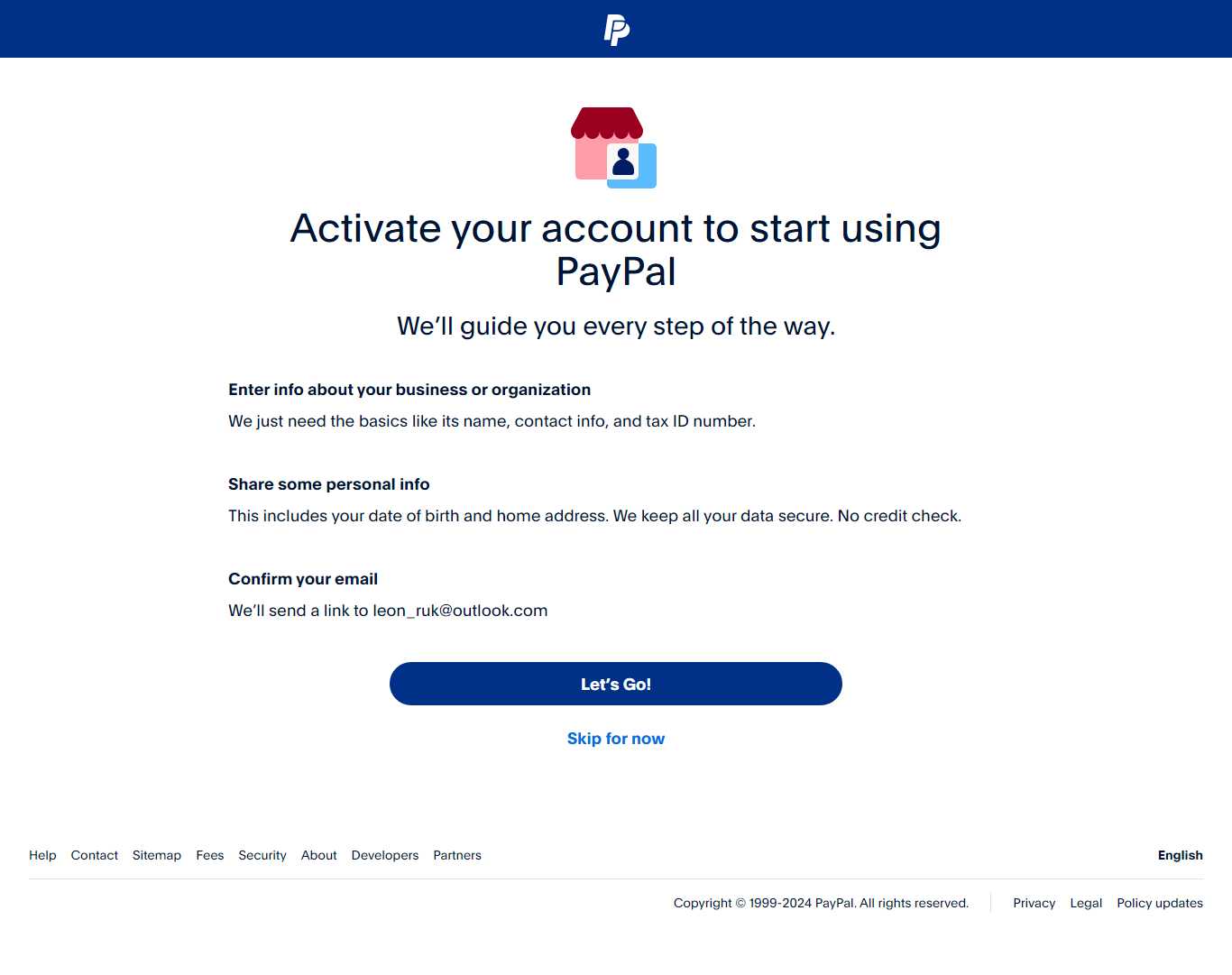

6. Click LET’S GO and start building your profile

6. Click LET’S GO and start building your profile

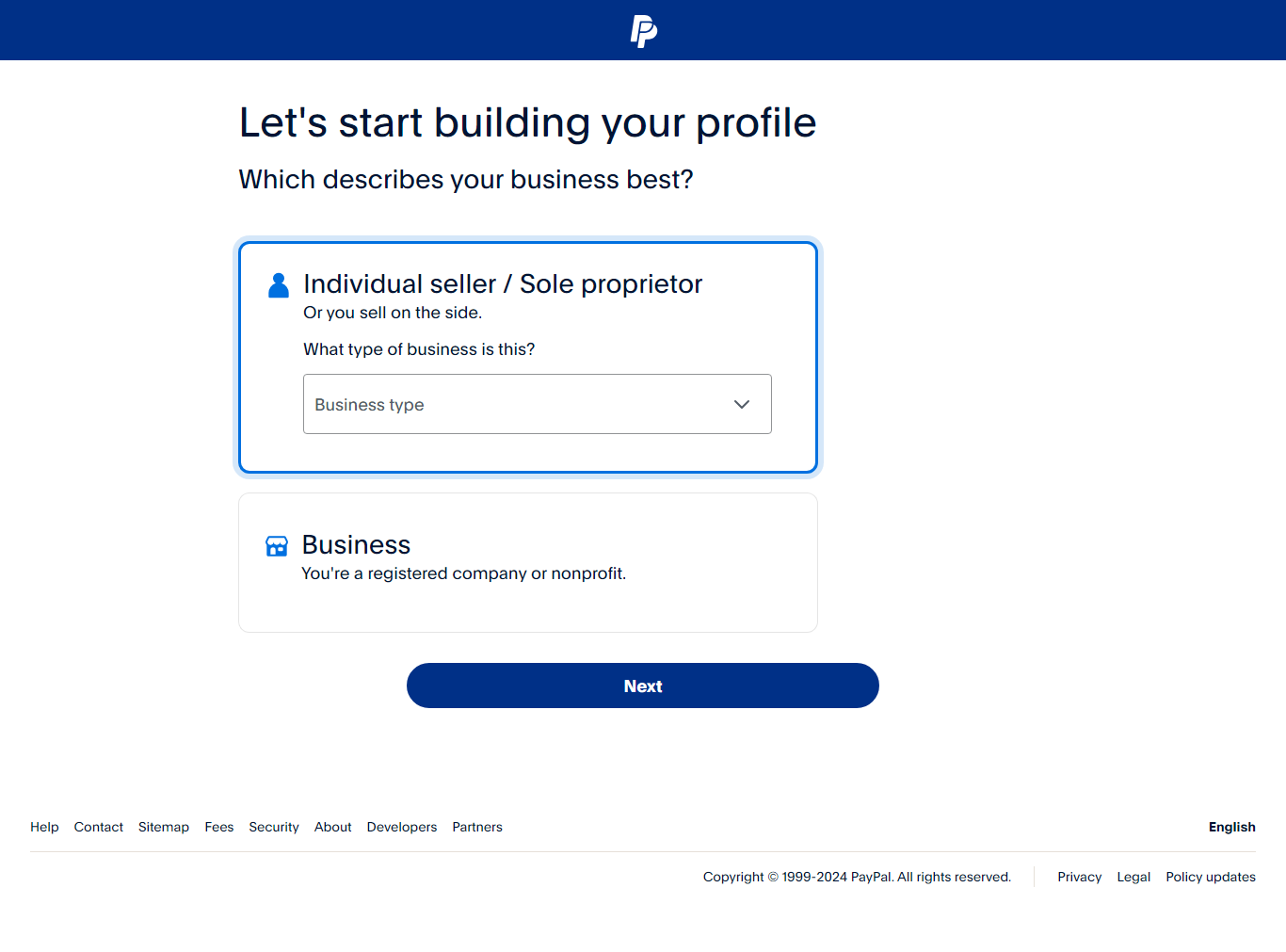

Choose individual

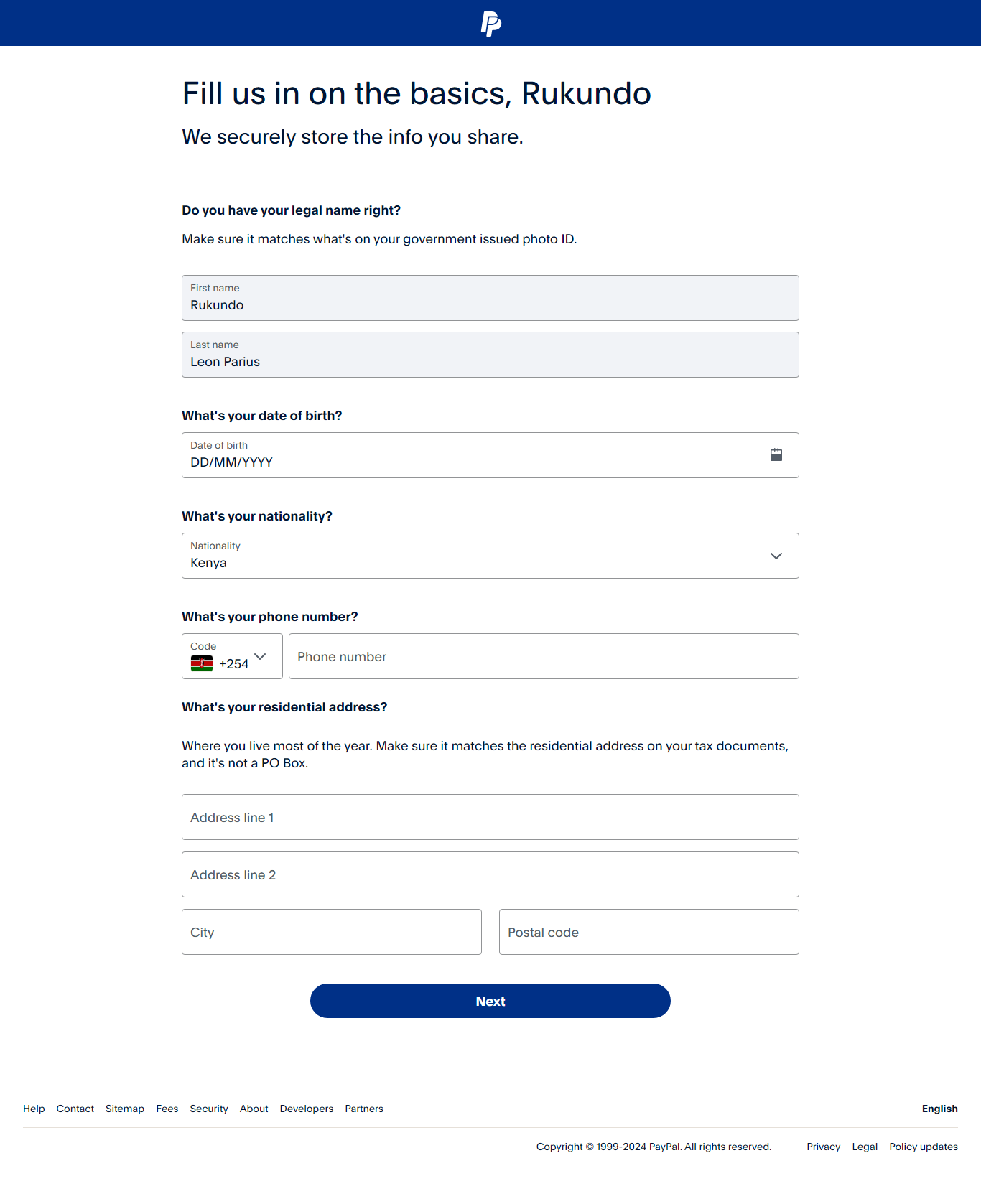

7. Fill in your details

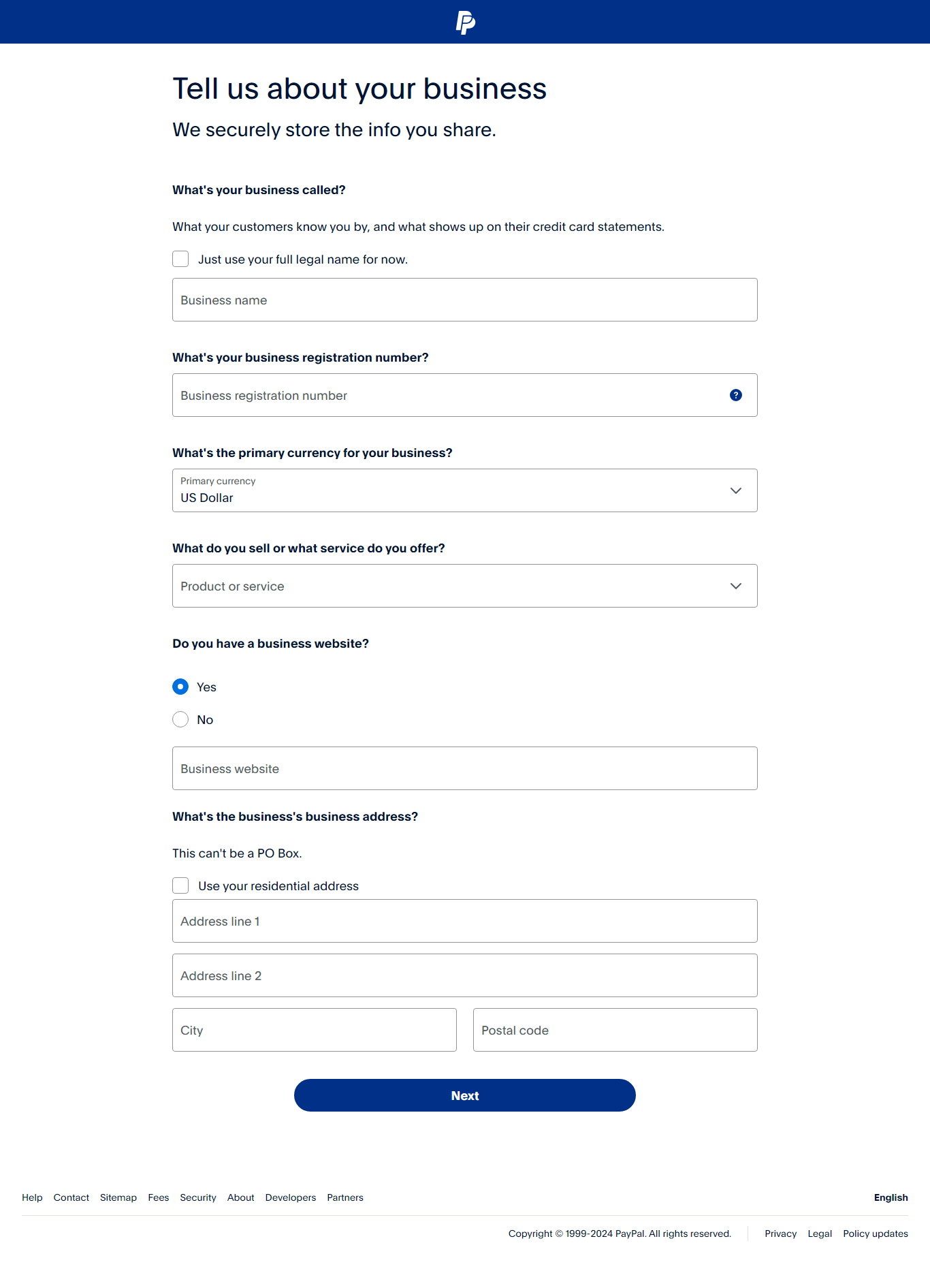

8. Fill in details about your Business

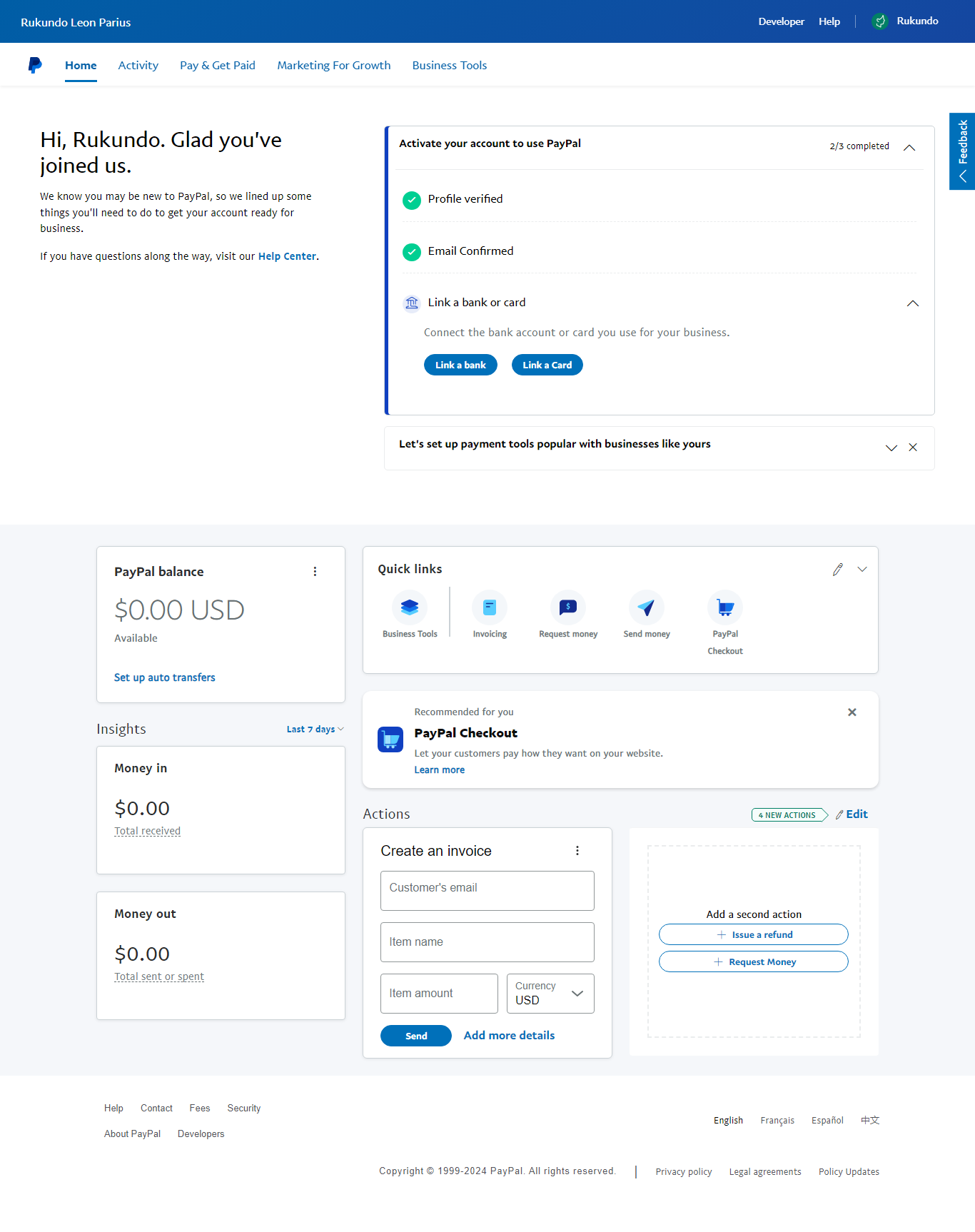

9. Account finished

10. Link a Payment Method(Optional):

10. Link a Payment Method(Optional):

You’ll need to link a valid payment method to your PayPal account. This can include a debit card, credit card, or bank account.

Follow the prompts within the PayPal interface to add and verify your chosen payment method.

11. Confirm Identity (if required):

Depending on PayPal’s verification procedures, you may be prompted to verify your identity. This could involve providing additional personal information or documentation to confirm your identity and ensure compliance with PayPal’s security measures.

12. Start Using Your PayPal Account:

You can now use your PayPal account to send and receive payments securely. Explore the various features and functionalities offered by PayPal to manage your online transactions effectively.

Views: 267

How to withdraw Money from PayPal In Kenya

When it comes to withdrawing funds from Paypal, PayPal Kenya offers two options as listed below;

1. Withdraw to Equity Bank Account:

PayPal allows you to withdraw money to your Kenyan Equity bank account and transfer funds directly. The withdraw process is normally done via the Equity bank App. For more details about Paypal to Equity bank withdraw, you can read on this link

https://equitygroupholdings.com/ke/pay-send-money/paypal/equity-bank-paypal-withdraw-service-terms-and-conditions

2. Withdraw to M-Pesa:

PayPal has partnered with M-Pesa, a popular mobile money service in Kenya, to allow users to withdraw funds directly to their M-Pesa accounts. This option provides quick access to cash, as funds are usually available in your M-Pesa account within minutes after the withdrawal is initiated.

You can connect your PayPal Kenya to Mpesa via this link; https://www.paypal-mobilemoney.com/m-pesa

The names on your Mpesa line have to match names used in your PayPal account

4. Withdraw to Payoneer:

Payoneer is a global payment service that provides prepaid Mastercard cards. PayPal allows users to withdraw funds to their Payoneer accounts, which can then be accessed through the Payoneer Mastercard. This option offers flexibility and accessibility, especially for users who prefer using prepaid cards for transactions.

Views: 267

Common Mistakes Leading to Permanent PayPal Suspension for Kenyan Users

While many Kenyans eagerly create PayPal accounts to facilitate online transactions, a significant number find themselves permanently suspended due to unintentional violations of PayPal’s terms and conditions. We shed light on the common mistakes made by Kenyan users during the creation of PayPal accounts, helping to raise awareness and prevent such unfortunate incidents.

1. Inaccurate Personal Information

One of the most common mistakes is providing inaccurate personal information during the account creation process. This includes incorrect names, addresses, or contact details. PayPal relies on accurate information for identity verification and compliance purposes. Any inconsistencies can trigger suspicion and lead to account suspension. It’s common for some users to even download IDs on internet and use them on PayPal accounts. This is Identity theft and ID got online might be used by several other people. Identity theft is a serious issue that can have severe consequences, including the suspension or closure of PayPal accounts. Using fake or stolen identification documents to create PayPal accounts is not only unethical but also illegal.

2. Using VPNs or Proxy Servers

Some Kenyan users resort to using virtual private networks (VPNs) or proxy servers to bypass geographical restrictions or access restricted content. However, doing so violates PayPal’s terms of service, as it obscures the user’s true location and may raise security concerns. PayPal may interpret this as fraudulent behavior, resulting in account suspension.

3. Multiple Accounts

Creating and managing multiple PayPal accounts from the same individual or household is against PayPal’s policies. Each user is allowed to have only one personal PayPal account. Attempting to create additional accounts can lead to all associated accounts being permanently suspended.

4. Suspicious Activity

Engaging in suspicious or fraudulent activities, such as sending or receiving funds for illegal purposes, can result in immediate suspension of the PayPal account. PayPal closely monitors transactions for signs of fraudulent behavior and takes swift action against violators.

5. Violating Acceptable Use Policy

Kenyan users must adhere to PayPal’s acceptable use policy, which prohibits certain activities such as gambling, adult content, or the sale of counterfeit goods. Failure to comply with these guidelines can lead to account suspension or termination.

6. Ignoring Verification Requests

PayPal may occasionally request additional documentation to verify the identity or legitimacy of the account holder. Ignoring these requests or providing insufficient documentation can result in account suspension. It is essential to promptly respond to verification requests and provide the requested information accurately.

Views: 267